CHICAGO – May 4, 2022 – Ryerson Holding Corporation (NYSE: RYI), a leading value-added processor and distributor of industrial metals, today reported results for the first quarter ended March 31, 2022.

Highlights:

A reconciliation of non-GAAP financial measures to the comparable GAAP measure is included below in this news release.

Management Commentary

Eddie Lehner, Ryerson’s President and Chief Executive Officer, said “Thank you to all of my Ryerson teammates for performing brilliantly in the quarter amidst existing and new adversities currently pervading and invading our world. I am grateful for the manner and result in which we continue pulling together with our valued customers and suppliers in determined pursuit of healthier, safer, more peaceful and more prosperous days. During the first quarter of 2022, Ryerson made the most of its opportunities illuminated by lower net debt, higher net book value of equity, a 25% increase in the quarterly dividend, significant expense leverage realizations, positive operating cash flow and record quarterly earnings per share. As we continue on our 180-year journey to provide great customer experiences across our intelligent network of value-added industrial metal service centers, our optimism around enduring secular drivers favoring recyclable industrial metals as a core enabler of sustainable growth and well-being is undiminished.”

Market Commentary

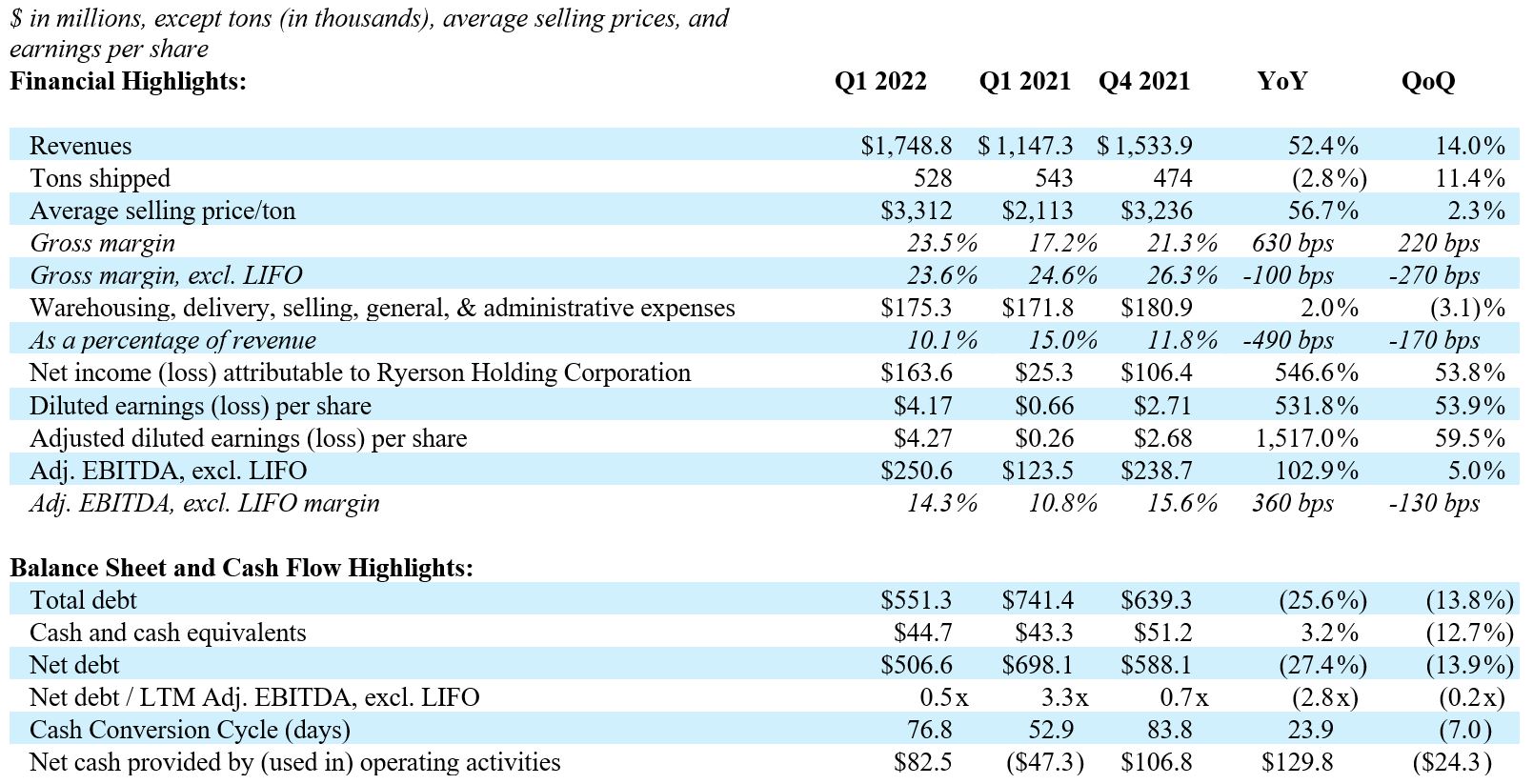

Our record revenue of $1.75 billion in the first quarter was driven by Average Selling Price (ASP) gaining 2.3% to $3,312 quarter-over-quarter and volume growth of 11.4% to 528 thousand tons sold. This compares to our guidance of ASP down 2% to 4% and volume guidance of 7% to 9% growth. Strong commercial and operational execution, coupled with continued improvement in underlying customer demand, drove this sequential improvement. According to Metal Service Center Institute (MSCI), North American service center volumes grew by 9.3% sequentially in the first three months of 2022 compared to the last three months of 2021. On a North American basis, Ryerson’s sales outpaced MSCI volume growth, with tons sold increasing 14.8% sequentially quarter-over-quarter.

Ryerson saw strong sequential volume shipment improvement in most of its end-markets in North America in the first quarter, notably led by increases in Commercial Ground Transportation of 20% and Construction Equipment of 19% as second half 2021 supply constraints in these markets eased. Heating, Ventilation and Air Conditioning (HVAC) grew 13% and continued to benefit from increased demand in the construction and home building sectors. While near-term supply constraints, cascading COVID-related shutdowns and war-hazards persisted throughout the first quarter of 2022, the North America manufacturing outlook for 2022 remains optimistic. Our base-case expectations are of a lessening of supply-chain disruptions and an accelerating demand release as the year unfolds, supported by price bellwethers holding well above their ten-year averages and improving customer backlog turnover.

First Quarter Results

Ryerson achieved record revenues of $1.75 billion in the first quarter of 2022, a sequential increase of 14.0% compared to $1.53 billion for the fourth quarter of 2021. Gross margin expanded sequentially by 220 basis points to 23.5% in the first quarter of 2022 compared to 21.3% in the fourth quarter of 2021. First quarter of 2022 cost of goods sold included LIFO4 expense of $2 million, compared to LIFO expense of $76 million in the fourth quarter of 2021. Excluding the impact of LIFO, gross margin contracted 270 basis points to 23.6% in the first quarter of 2022 compared to 26.3% in the fourth quarter of 2021. The Company maintained noteworthy expense leverage in the first quarter of 2022 as warehousing, delivery, selling, general and administrative expenses as a percent of revenue declined to 10.1% compared to 11.8% in the fourth quarter of 2021.

Net income attributable to Ryerson Holding Corporation for the first quarter of 2022 was $163.6 million, or $4.17 per diluted share, compared to $106.4 million, or $2.71 per diluted share in the previous quarter. The first quarter of 2022 includes a charge of $5.3 million related to loss on the retirement of debt, compared to a $1.9 million gain on the sale of assets in fourth quarter of 2021. Excluding these one-time items and the associated income taxes, adjusted net income attributable to Ryerson Holding Corporation for the first quarter was $167.5 million, or $4.27 per diluted share, compared to $105.0 million, or $2.68 per diluted share, for the fourth quarter of 2021. Ryerson generated first quarter Adjusted EBITDA, excluding LIFO of $250.6 million in the first quarter of 2022 compared to fourth quarter 2021 Adjusted EBITDA, excluding LIFO of $238.7 million.

Liquidity & Debt Management

Ryerson generated $82.5 million of operating cash in the first quarter of 2022 driven by strong operating profit, net of $75.6 million in working capital use. The Company’s cash conversion cycle improved to 77 days in the first quarter of 2022 from 84 days in the fourth quarter of 2021. Ryerson’s leverage ratio for the first quarter of 2022 improved quarter-over-quarter to 0.5x from 0.7x, a record low since our Initial Public Offering in 2014. The Company ended the first quarter of 2022 with $551 million of debt and $507 million of net debt, a decrease in net debt of $81 million compared to $588 million for the fourth quarter of 2021 driven by strong operating results. The Company’s available global liquidity, composed of cash and cash equivalents and availability on its revolving credit facilities, increased to $760 million as of March 31, 2022 compared to $741 million as of December 31, 2021.

Growth Initiatives

Acquisitions. On March 2, 2022, Ryerson announced the acquisition of Apogee Steel Fabrication Incorporated, a sheet metal fabricator based in Mississauga, Ontario Canada. Apogee is a full-line fabrication company providing shearing, punching, forming, and laser cut processing in addition to welding and hardware assembly services. Apogee provides complex fabrication assemblies in stainless steel, aluminum and carbon sheet and strengthens Ryerson’s network of value-added service centers in Canada, adding to our processing capabilities and growing our full-service fabrication business.

Modernization projects. We are progressing toward the completion of two new state-of-the-art service center facilities in Centralia, Washington, and University Park, Illinois, at an estimated combined capital improvement budget of $45 million in 2022. The Centralia project is on schedule to become fully operational by year-end. Our University Park campus, where site preparation recently began, is the future hub of Central Steel & Wire. These projects illustrate Ryerson’s “monetize and modernize” approach as both projects utilize sales proceeds of prior locations, while maintaining customer loyalty and delivering vastly improved facilities to enhance the customer experience.

Shareholder Return Activity

Dividends. On May 4, 2022, the Board of Directors declared a quarterly cash dividend of $0.125 per share of common stock, payable on June 16, 2022 to stockholders of record as of June 2, 2022. During the first quarter of 2022, Ryerson returned approximately $4.3 million to shareholders in the form of dividends and share buybacks. We paid a quarterly dividend in the amount of $0.10 per share, amounting to a cash return of $3.8 million for the first quarter of 2022. Further, we repurchased a total of 20,510 shares at an average price per share of $25.27 resulting in a return to shareholders of approximately $0.5 million for the first quarter. Ryerson made these repurchases in accordance with its share repurchase program, which authorizes the Company to acquire up to an aggregate amount of $50.0 million of the Company’s common stock through August 4, 2023 with $47.7 million of authorization remaining.

Bond buyback. During the first quarter of 2022, Ryerson repurchased $63.1 million of its Notes using cash generated from operations at an average cost of 108.5%. As of March 31, 2022, there was $236.9 million of Notes outstanding. A $5.3 million loss on retirement of debt associated with the notes repurchases was recorded in our first quarter 2022 income statement and is excluded from adjusted net income and adjusted diluted earnings per share.

Bond Repurchase Authorization. On May 4, 2022, the Board of Directors approved a bond repurchase program authorizing the Company to repurchase up to $172 million of its Notes. This bond repurchase program is in addition to the Company’s special redemption right to redeem up to $50 million in principal.

Jim Claussen, Executive Vice President & Chief Financial Officer commented, “Our balance sheet continues to make step-change improvements, with our net debt declining to $507 million, a record low since our IPO in 2014. Taking advantage of market conditions during the first quarter, we were able to opportunistically repurchase $63.1 million of our 8.5% Notes, which is estimated to be accretive to earnings by approximately $0.10 per share on a tax-effected annualized basis. Adding to this, our board approved repurchasing an additional $172 million of Notes, which the Company may execute by December 31, 2022. Lastly, for the third quarter in a row, we were pleased to announce a sequentially higher quarterly dividend, boosting our payout by 25.0% to $0.125 per quarter. These achievements underscore the thoughtful redeployment of free cash flow toward increased shareholder returns.”

Outlook Commentary

Ryerson remains optimistic about the industrial metals and manufacturing environment. We expect to see seasonal sequential improvement in company shipments during the second quarter of 2022. To date, carbon products have experienced a favorable price recovery relative to the first quarter, while aluminum and nickel prices have again improved quarter-over-quarter. The Company’s diversified commodities mix, which sales includes approximately 50% stainless steel and aluminum, stands to benefit from strength in its bright metals franchise. Therefore, Ryerson anticipates second quarter 2022 revenues in the range of $1.75 billion to $1.80 billion, with sequential average selling prices to be up 0% to 2%, and shipments up 0% to 2%. LIFO expense in the second quarter of 2022 is expected to be zero. Adjusted EBITDA, excluding LIFO is expected to be in the range of $250 to $260 million and earnings per diluted share is expected to be in the range of $4.30 to $4.49.

Earnings Call Information

Ryerson will host a conference call to discuss first quarter 2022 financial results for the period ended March 31, 2022, on Thursday, May 5th, at 10 a.m. Eastern Time. The live online broadcast will be available on the Company’s investor relations website, ir.ryerson.com. A replay will be available at the same website for 90 days.

About Ryerson

Ryerson is a leading value-added processor and distributor of industrial metals, with operations in the United States, Canada, Mexico, and China. Founded in 1842, Ryerson has around 4,000 employees in approximately 100 locations. Visit Ryerson at www.ryerson.com.

Vice President - Finance:

Jorge Beristain

312.292.5040

investorinfo@ryerson.com

Legal Disclaimer

The contents herein are provided for general information purposes only and do not constitute an offer to sell or buy, or a solicitation of an offer to buy, any security (“Security”) of the Company or its affiliates (“Ryerson”) in any jurisdiction. Ryerson does not intend to solicit and IS not soliciting, any action with respect to any Security or any other contractual relationship with the Ryerson. Nothing in this release, individually or taken in the aggregate, constitutes an offer of securities for sale or buy, or a solicitation of an offer to buy, any Security in the United States, or to US persons, or in any other jurisdiction in which such an offer or solicitation is unlawful.

Safe Harbor Provision

Certain statements made in this presentation and other written or oral statements made by or on behalf of the Company constitute "forward-looking statements" within the meaning of the federal securities laws, including statements regarding our future performance, as well as management's expectations, beliefs, intentions, plans, estimates, objectives, or projections relating to the future. Such statements can be identified by the use of forward-looking terminology such as “objectives,” “goals,” “preliminary,” “range,” "believes," "expects," "may," "estimates," "will," "should," "plans," or "anticipates" or the negative thereof or other variations thereon or comparable terminology, or by discussions of strategy. The Company cautions that any such forward-looking statements are not guarantees of future performance and may involve significant risks and uncertainties, and that actual results may vary materially from those in the forward-looking statements as a result of various factors. Among the factors that significantly impact our business are: the cyclicality of our business; the highly competitive, volatile, and fragmented metals industry in which we operate; the impact of geopolitical events, including Russia’s invasion of the Ukraine and global trade sanctions; fluctuating metal prices; our substantial indebtedness and the covenants in instruments governing such indebtedness; the integration of acquired operations; regulatory and other operational risks associated with our operations located inside and outside of the United States; impacts and implications of adverse health events, including the COVID-19 pandemic; work stoppages; obligations under certain employee retirement benefit plans; the ownership of a majority of our equity securities by a single investor group; currency fluctuations; and consolidation in the metals industry. Forward-looking statements should, therefore, be considered in light of various factors, including those set forth above and those set forth under "Risk Factors" in our annual report on Form 10-K for the year ended December 31, 2021, and in our other filings with the Securities and Exchange Commission. Moreover, we caution against placing undue reliance on these statements, which speak only as of the date they were made. The Company does not undertake any obligation to publicly update or revise any forward-looking statements to reflect future events or circumstances, new information or otherwise.

Notes:

1Leverage ratio – Net debt divided by trailing twelve month adjusted EBITDA, excluding LIFO expense/income

2Net debt – Total debt less cash and cash equivalents.

3Book value of equity – Total assets minus total liabilities.

4In the first quarter of 2022, we changed the method we use to estimate LIFO on an interim basis. This is a change in accounting estimate that is inseparable from a change in accounting principle. Historically, interim LIFO calculations were based on actual inventory levels and costs at each interim period. In the first quarter of 2022, we elected to recognize the interim effects of the LIFO inventory valuation method by projecting expected year-end inventory levels and LIFO costs and allocating that projection to the interim quarters on a pro-rata basis. We believe this change is preferable as it results in a better estimate of LIFO for the full year, creates less volatility in earnings on an interim basis, and makes our results more comparable to our peers.

For full release details see ir.ryerson.com.